Aren’t we tired of supporting leaders and government who do not have a clear and comprehensive understanding of sustainability? In Malaysia, we are destroying the environment, as if there is a Planet B we can move to.

Malaysia’s ideological disease terrorises all the same

March 24, 2019

by Dr. Azly Rahman

COMMENT | My previous column warning of inciteful preaching, which reached 30,000 readers in three days, was removed from Facebook for “violating community standards.”

As if there is a contagious ideological disease plaguing those who do not understand what the message of peace looks like. Somebody didn’t like my message of peace. Fine. I’ll continue writing. I’ll continue to wage peace using the internet, still a powerful medium of dialogue.

There was some consolation though: Such a beautiful Friday prayer session I saw live from New Zealand. Poignant and filled immensely with the message of peace. Such a beautiful display of respect and love by New Zealanders including Prime Minister J. Arden being there to comfort Muslims who lost their loved ones.

In a 2017 study on the “most Islamic country in the world,” New Zealand was at the top spot, and Saudi Arabia in comparison, was 47th in the list. This is the meaning of an Islamic state and the Islamicity of it: social justice, human rights, sustainability and personal freedom – the antidote to terrorism, to ideological diseases.

Religious aggression

I thought of this question this week: of peace, conflict, and the root cause of terrorism, as well as where the country is going to when it comes to environmental degradation.

How shameful America is when it comes to gun control laws, compared to New Zealand’s ban on assault rifles.

Of course, the issue is complex because it is about rights: to bear arms, and how American are so institutionalised about amendments that protect this and that right. But I do believe that gun control begins with parents banning toy guns in the house – violence need not be a plaything.

We are living in a world where a contagious disease of a different kind exists: ideology. Of the link between consciousness, culture, and economic conditions. This manifests in violence that has become more structural or unseen, engulfing the minds of the masses.

Consider the advancement of terrorism in our region, as Islamic State moves its operations to Southeast Asia. Poverty and lack of exposure to liberal education are the main causes of the rise of terrorism. Address these, as they contribute to the advancement of this ideological disease.

My advice to Muslims: Preach not about Islam if you still have a poor understanding of the wisdom of it. Of the concept of the four branches of knowledge, shariat-tariqat-hakikat-makrifat. Just live a life based on that.

If every Muslim preaches to himself/herself and to the family first, we don’t need preachers preaching jihad.

Private religion. The thousand-year-old Holy War seem to be reenacting globally in newer forms and styles, with the semiotics and semantics of terror. And now, we want to bring back IS fighters, lack the will to prosecute polluters and harbour hate preachers. What’s wrong with us?

Environmental aggression

Consider the environmental terrorism we are witnessing. Of what happened recently in Pasir Gudang.

Malaysians need to know the companies that pollute rivers and dump waste. They need to also know which powerful people own them. The pollution in Pasir Gudang could have killed dozens of schoolchildren and citizens. Which company is responsible?

The government should go after companies that pollute and poison the rivers, as well as the ones that destroy our rainforests and mangrove reserves. Name the companies involved in destroying our environment and which powerful and wealthy people own them.

The media should be more active in exposing the interlocking directorships of these corporate criminals destroying us. Name the company that dumped poison into Sungai Kim Kim near my hometown. Who owns it? Johoreans want to know!

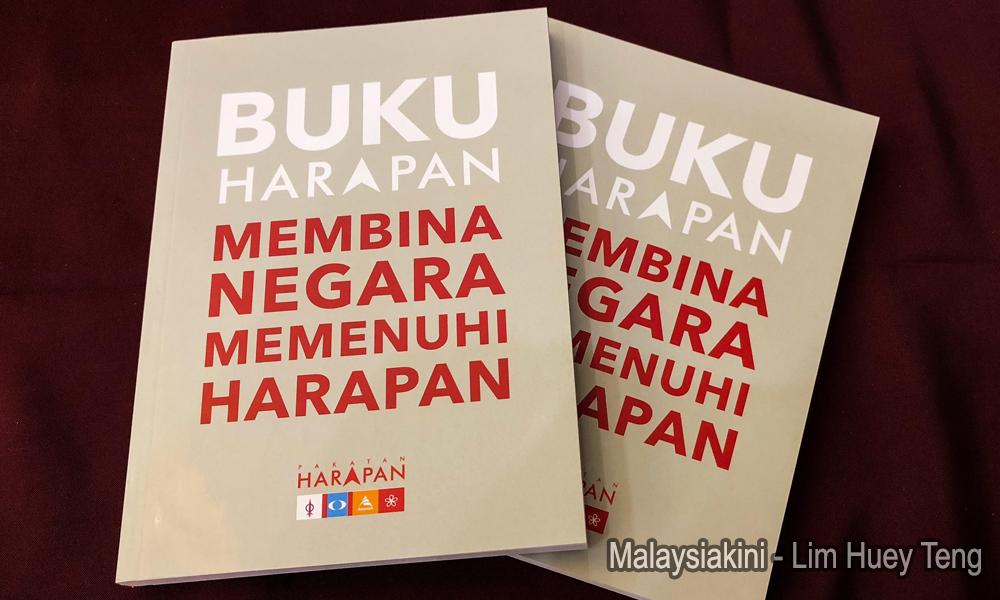

Unless the Pakatan Harapan government doesn’t care, it must help citizens fight ecological terrorists – the companies that destroy our environment. States such as Johor seem to be ravaged by mindless industrialists who do not care about environmental impact.

Aren’t we tired of supporting leaders and government who do not have a clear and comprehensive understanding of sustainability? In Malaysia, we are destroying the environment, as if there is a Planet B we can move to.

Parent action groups in Malaysian education and NGOs must help parents and citizens in Pasir Gudang go after those responsible. Our children must be given the right to demand a saner, cleaner, and safer planet.

Economic aggression

As we speak, we are reading more about how gung-ho our economic plans are. Bordering on economic terrorism, a nucleus in this contagious ideological disease.

You pour in billions of ringgit into Kedah, for example, and let East Malaysia continue to live in poverty?

Is this the new regime’s smartest developmentalist ideology? Or the same old system of patronage? I grab power, I design projects, my party members benefit. This ideology of developmentalism is not sustainable if it continues to create haves and have-nots in society.

Worse, these projects created and monopolised by politicians are to ensure their children will be well-fed for seven generations. A shrewd Machiavellian will have the different groups fight over crumbs and illusions, while he orchestrates the biggest robbery.

Race and religion

While all these racial and religious issues are being played up, huge businesses dealings are being made by politicians. As usual.

We have to teach the masses to see beyond false consciousness, to identify this contagious ideological diseases. In Malaysia, politicians use religious preachers as spiritual trouble makers, to blind the people of real race and class issues.

Terrorism can only be eliminated when all religions are seen as equal and practical, and class divisions and poverty ended.

The more you give power and your ears to the TV preacher, the more he’ll become big headed. All television evangelists wish to make money, whether you call it Peace TV or God’s Cable Channel. Big business for the gullible.

Today, everybody wants to push their own truth, not knowing that everyone is a truth in itself to be constructed. At my age, the dialogues of religion, spirituality, existentialism happen only within me, bored I am of public forums on truth.

All religions need not be defended if the devotees keep their understanding to themselves and enjoy the journey. You bring in a radical preacher into your country, he’ll bring his country’s violent conflict to mess up your society.

Politicians hiding behind the gown of religious fanatics and hate speech champs have no moral direction. Vote them out! Let us continue to support each other in fighting hatred and hate speech. Begin at home. Educate for basic respect for others.

Wage peace

What is the root cause of terrorism? The manufacturing and creating of deadly crises, so that the global arms industry – of light arms to massive smart bombs – may flourish.

Poverty, rock-logic religion, the lack or total rejection of liberal education, and for the inciters, power to influence and the huge appetite to be megalomanic preachers – these are the root cause of the ideological disease.

Power given by the ignorant and powerless to worship those who are masters of deception, perception, and religious and ideological militancy – this is what fuels the deadly cells of violence. That contagious ideological disease we’ve been talking about.

But today, my heart goes to those in Christchurch massacred after Friday prayers. By a terrorist. By a force growing larger than the IS, in due time: white supremacist terrorists. A global contagious ideological disease finally been diagnosed as how it should be.

Wage peace, not war. Contain the ideological diseases spreading like wildfire. This is rent we must pay for living in this increasingly violent world.

AZLY RAHMAN is an educator, academic, international columnist, and author of seven books available here. He grew up in Johor Bahru and holds a doctorate in international education development and Master’s degrees in six areas: education, international affairs, peace studies communication, fiction and non-fiction writing. He is a member of the Kappa Delta Pi International Honour Society in Education. Twitter @azlyrahman. More writings here.

The views expressed here are those of the author/contributor and do not necessarily represent the views of Malaysiakini.

In 1950, the British reacted with a mixture of horror and disdain to the proposed European Coal and Steel Community, suspecting a French plot to lure a pragmatic people into some utopian foreign project. The basic arguments against “Europe” have not changed at all since then, unlike the consequences of acting on them.

NEW YORK – On May 9, 1950, when European countries were just beginning to emerge from the ruins of war, the French statesman Robert Schuman announced his plan to create the European Coal and Steel Community. By pooling these vital war materials under a common European authority, violent conflict between France and Germany would become unthinkable. The Germans were delighted. The Benelux countries and Italy would take part as well. A first step toward a European union had been taken. Shortly after Schuman’s announcement, the British were invited to join in the discussions.