August 29, 2018

Malaysia: Protect our Financial and Economic Resilience

by Martin Khor

.jpg)

As we found out in the 1997-99 financial crisis, and as the Turkey implosion is now reminding us, it is crucial to defend our economic independence, and that can be done only by keeping out of a debt crisis.

IT’S a few days more to National Day. It’s a good time to remember that nothing is more precious than our independence, where we have the right and means to determine our own economic and social policies.

With that freedom and space, the country and its leaders must then make and implement good policies and practices that improve the people’s lives and well-being.

This is easier said than done. A wrong turn on the road can land the country in trouble, and its independence can even be snatched away.

The new Pakatan Harapan government has highlighted how government borrowings had increased explosively under the previous regime, until the country was on the brink of a debt crisis.

Averting that trap has correctly been a top priority of the government during and after its first 100 days.

Prime Minister Tun Dr Mahathir Mohamad’s trip to China last week was aimed at addressing the high cost of three projects. Their cancellation or postponement results in compensation costs, but these will be less wasteful than pouring money into the over-priced projects.

Malaysia’s ex-Finance Minister thinks that he is a Fiscal Genius. He has been charged with corruption and abuse of power.

There is also the 1MDB saga and many other direct or government guaranteed loans that went sour. If loans are taken for projects that do not yield enough revenue to service the debts, they add to the problem. And if the total loans are huge, the government is in trouble.

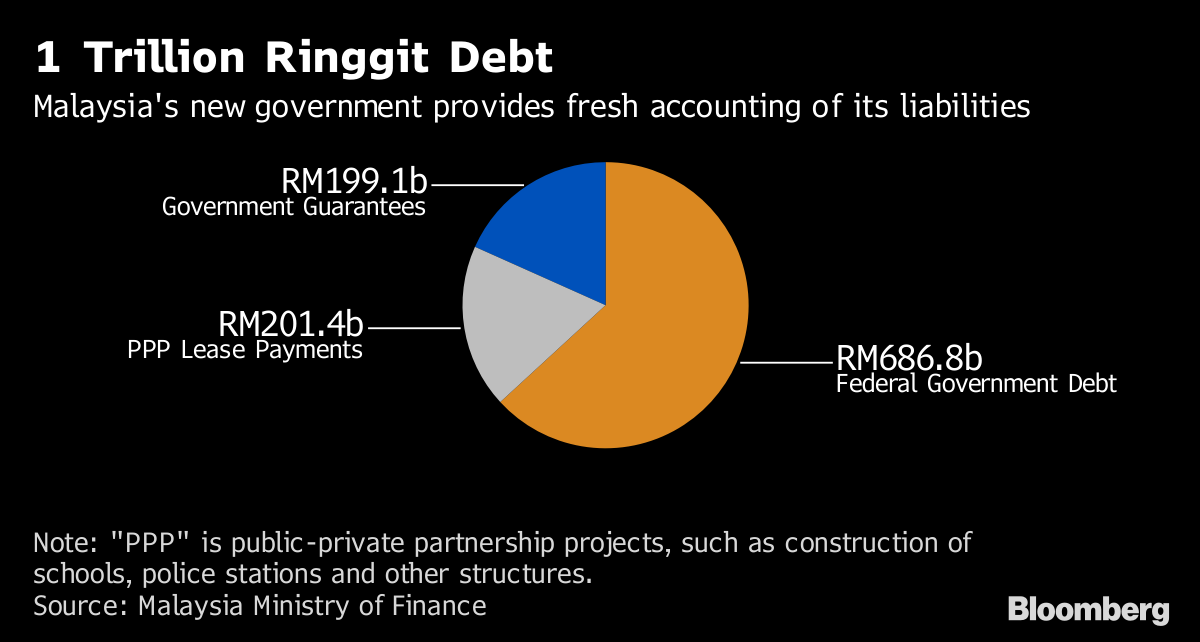

Since the federal government debt has reached one trillion ringgit or more, it is imperative to bring it down to a manageable level. Not an easy job at all.

Already a large part of the government budget must be set aside to service the debt, with less available for operations and development.

Some of the Pakatan manifesto promises will have to take longer to fulfil because there is less money. Many understand that saving the country from economic disaster is more important than having goodies now that we can’t afford.

For example, cancelling all highway tolls just can’t be done now, and may be unwise even later; at the least, it should be selectively done. Revenue should be raised for example by increasing “sin taxes” on cigarettes and gambling, and by new taxes on sugar-filled products, including soft drinks.

Many projects on the drawing board or in the pipeline should be reviewed. Even some projects that make sense may need to be postponed. Those that are not economically feasible – they can’t yield sufficient revenue – should not be implemented, unless they are really urgently needed.

Besides their overly high cost estimates, some projects have projected revenues that are unrealistically hiked up, for example, those that rely on over-blown estimates of the numbers of people who will use a highway or a train service.

In designing and carrying out reforms, it is important that the government ensures that the costs of policy adjustments do not fall on the bottom sections of society.

While the focus has been on government debt, it is also necessary to carefully manage the country’s external debt. These are debts owed to foreigners and foreign institutions by the government and its enterprises, private companies and banks.

In recent years, the country’s external debt has been growing, reaching RM936bil at end-June. This comprises the external debt of government (RM184bil), banks (RM354bil), other institutions including companies (RM387bil) and monetary authorities (RM12bil).

About two-thirds of the total debt is denominated in foreign currency (mainly US dollars) and a third (mainly government bonds) are ringgit-denominated.

Though the external debt level is high, Malaysia currently does not have a problem servicing it. The international reserves – RM421.7bil at end-June – are sufficient to cover the debt servicing costs. There is a need, however, to keep close tabs because the international situation has darkened considerably. And many countries, Malaysia included, are affected.

A “perfect storm” has in fact started. The United States has stopped pumping billions into its banking system, thus reversing its quantitative easing policy. So there is now less liquidity and US interest rates are rising.

Funds that surged into emerging economies are moving out. Currencies of developing countries are declining against the US dollar, and their stock markets are declining. The trade war is adding to the gloom.

All that’s needed is a trigger to set off a chain of events. This seemed to have arrived with the currency crisis in Turkey.

The country was already very vulnerable, with a big current account deficit, large external debt, low foreign reserves and high inflation. When the US doubled the tariffs on Turkey’s steel, that triggered an exodus of funds from Turkey and a fall in its currency, which has lost 40% of its value against the US dollar since the start of the year.

The Turkish government is now in full battle mode, trying to keep the country from having to go to the International Monetary Fund for a bailout. It is in a tough fight trying to defend its economic independence.

Spooked by the Turkey crisis, on top of the trade war, foreign funds in the past few weeks have been leaving many developing countries, including Malaysia.

The dreaded term “contagion effect” is increasingly used to describe the situation. Most vulnerable are countries that have high external debts, current account deficits and low reserves. Fortunately Malaysia is not in the frontline of these crisis-prone countries.

But there is global turbulence on the near horizon, and we should prepare for it, on top of the efforts to control the domestic problems of government debt, budget deficit, unviable projects, a high cost of living and a host of social issues.

As we found out in the 1997-99 financial crisis, and as the Turkey implosion is now reminding us, it is crucial to defend our economic independence, and that can be done only by keeping out of a debt crisis.

A country forced to take a bailout loan from the IMF faces conditions that are often humiliating and inappropriate. It loses its independence.

So let us happily celebrate the Merdeka anniversary, for there is much to be glad about this year with a new government that brings the promise of a New Malaysia.

But let us also remind ourselves of the importance of retaining enough freedom to make our own policies, and to ensure we do make the right policies to maintain and defend our economic independence and national sovereignty.

Martin Khor is adviser of the Third World Network. The views expressed here are entirely his own.