Lina O wants to know: Who lied?

Answer: You did, Lina. And so did Najib Razak, and Zahid Hamidi, and Adnan, and Apandi, and Arul…. and, of course, Chubby Low. Unfortunately, very unfortunately, you were being human.

1MDB was built on a tomb of lies

Dear Azalina/Lina:

You’ve been lying and lying and lying, but you can’t help it. How can you? You don’t even know your own lies.

Let’s begin with the Saudi Foreign Minister, whose remarks centered on two ingredients. One, the Saudi government is ‘aware’ of investigations into a certain ‘donation’, amount unstated, source anonymous, and so on (see Chedet: Money Trail). Two, the ‘donation’ was unconditional.

Now, contrast those remarks against the unknown and the unstated. The minister’s remarks are actually regurgitation, vomit, that on countless occasions had been recycled by Najib Razak’s ministers (‘recycle’ is Arul’s favorite red herring word used to throw our scent off from getting straight answers). As a result, those words resurrect old problems that hadn’t been addressed before.

One, when is a ‘donation’ a donation? An example in this question: ‘A’ steals from Bank X then transfers to ‘B’ who in turn deposits half the loot into A’s Bank Y. Is B donating to A — technically? Two, why don’t those towel head Saudis come straight, right out to say it: “Here’s the donor, here is proof of yearly earnings, in USD billions, here’s the remittance receipt, here is the money back. We consider the case closed.” Instead, the minister actually recycles Najib’s Arulian spittle. Why?

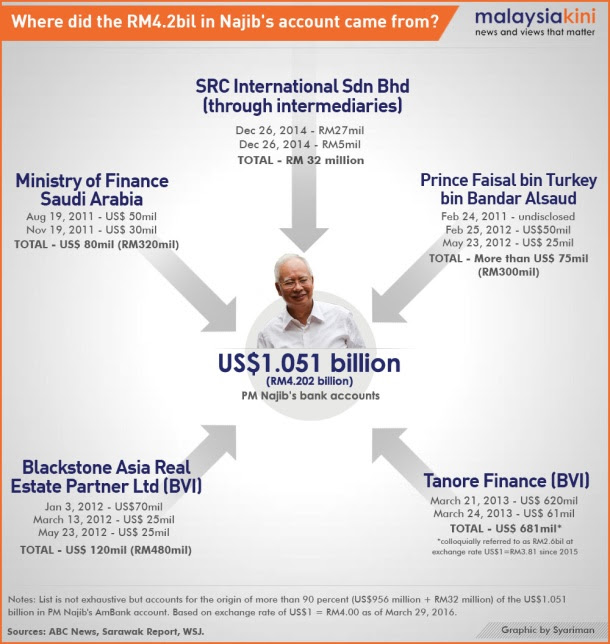

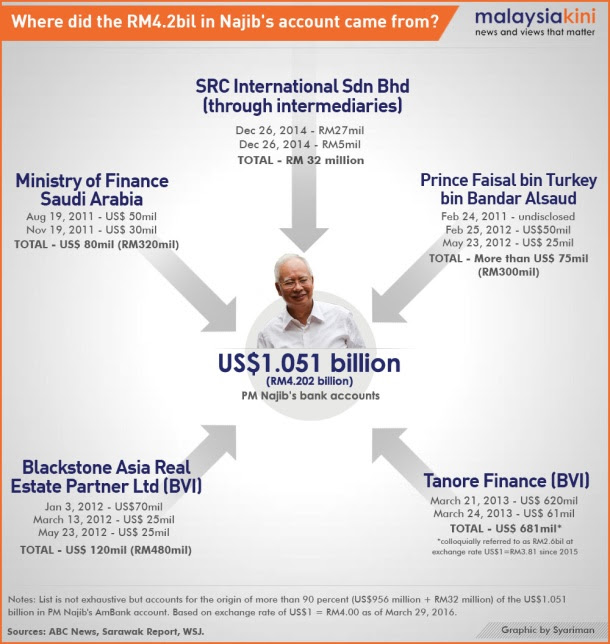

The worse for the inanity is this, Lina: with those remarks, you went to town gloating, and that in writing, too. Why? There was nothing new in them. On the contrary, the Saudi man doesn’t even say the donation is a ‘political fund’ which, if you remember, Lina, you said late last year was the purpose of the US$681 million. First, there was no such money, after that the money was a form of Islamic ‘reward’, then ‘political funding’, and now it’s a ‘genuine’ personal donation.

Can you, Lina, sense the lie on the lie on the lie on the lie? Said so often, you are beginning to believe your own lies. You can’t even tell one lie from another, much less the truth from them. You can’t even tell when a donation ceases to be a donation and, therefore, see that a donation can be a form of gratification — words contained in the MACC Act. Look it up, since you are lawyer, ableit a kaki ampu bodek.

Then there is the matter of conditionality. For someone to drop US$681 million into your bank account, expecting nothing in return, is an un-human feat and, worse for it, when this is done in the name of your God. Think about it for a minute, Lina: Why is it un-human?

But to pass around embezzled money, whether this is done by thieves or politicians, is pure human reaction. Consequently, it has to be unconditional. In colloquial terms, it is called splitting the loot. What need is there to expect anything in return when the money hadn’t originally come from nor does it belong to the donor? Nor recipient.

Lina, can you not see? Your lies cloud your judgment. After which, you mentioned of a letter published by the Australian Broadcasting Corporation which you say reaffirms the Saudi’s remarks. Is this it?

Click on image for an enlarged view.

It was with that letter plus two consecutive findings you cited from Apandi Ali and parliament’s Public Accounts Committee (PAC) that led you to believe Najib is innocent of all the accusations. So, let’s go into your arguments. Apandi (A-G)first.

Essentially, the A-G says (a) there is ‘no evidence’ to trace money going from 1MDB to Najib. Instead, (b) there is evidence to show that money went from a Saudi national to Najib. Therefore, no crime.

Before going further, a little history. But, re-read the Saudi letter above, dated 2011, alongside the two statements from International Petroleum Investment Co, below, five years later.

On September 2009, Najib signed a deal with the Saudis, creating the 1MDB-PetroSaudi joint venture (JV) with Malaysia putting in US$1 billion. Then from March 2011 onwards, barely 18 months after the JV, 1MDB began raising US$3.5 billion in two bond tranches through Goldman Sachs (there was a third in Mar 2012, raising US$3 bn). If Goldman were to raise that kind of money, it needs guarantees. So Najib goes not to his business partners, the Saudis, but their neighbors, the UAE, IPIC to underwrite both deals.

Some Saudi may give to Najib US$681 million for nothing, but not IPIC. It has shareholders and the London Stock Exchange (LSE) to answer to. So, in its turn, IPIC asks Malaysia for collateral but at that early stage, year 2010, what has 1MDB got other than MYR1 million as paid-in capital? Nothing, not the JV, no Argentinian oil fields, no Turkmenistan. Nothing, except this: a lien on the power assets — later known as Edra Energy — with which US$3.5 bn was supposed to buy, starting with Tanjung Power.

Most of the money never went to those power plants anyway but transferred instead to some island bank accounts. Now, worse for IPIC, Arul has sold all of Edra, alongside the Bandar Malaysia land (used partly as justification to raise the third, US$3 bn tranche of bonds). Those sales left the Emirate holding what for collateral? Nothing, but a worthless piece of promise on paper.

This train of affairs isn’t a matter of speculative conjecture but constitutes an easily traceable chain of events but are now unraveling. And this event series is documented, such as with bank transactions and, now, the Saudi letter and IPIC’s most recent two LSE statements (below). IPIC statements are most revealing, saying as if they had had enough not only of 1MDB but also — and get this right — the Ministry of Finance. Meaning, Najib. They must have reasoned, ‘why is it that Najib can, at the snap of finger, get up to a billion but can’t show us any money to honor 1MDB deals with us? Have we been exploited — no, cheated — to cover a scam?‘

IPIC statements exposed the terrible experiences they had in making deals with Malaysians: Above, 1MDB lied to us, IPIC says, and in their accounts. We didn’t get the money. Below, IPIC to MoF in a statement for the London Stock Exchange, all deals are off, we might sue.

1MDB Debt Settlement Arrangements

On 28 May 2015, International Petroleum Investment Company (IPIC), Aabar Investments PJS (Aabar), Minister of Finance, Inc., Malaysia (MOF) and 1Malaysia Development Berhad (1MDB) entered into a binding term sheet that provides for the following principal matters:

· on 4 June 2015, IPIC provided US$1 billion to 1MDB for 1MDB to utilise immediately to settle certain of its liabilities (the Cash Payment);

· from 4 June 2015, IPIC has assumed the obligations to pay (on an interim basis) all interest due under two IPIC guaranteed 1MDB financings amounting to US$3.5 billion in aggregate principal amount (the Notes);

· upon the completion of the transfer of assets as described below, IPIC will directly assume liability for all payment obligations under the Notes (the Assumption of Debt) and forgive certain financial obligations of the 1MDB Group to the IPIC Group (the Debt Forgiveness); and

· by 30 June 2016, IPIC is to have received a transfer of assets with an aggregate value of an amount which represents the sum of the Cash Payment, the Assumption of Debt and the Debt Forgiveness.

1MDB and MOF have agreed to perform the obligations contemplated in the binding term sheet and to indemnify IPIC and Aabar for any non-performance, and vice versa.

IPIC has met the Cash Payment and will meet the interim interest payments under the Notes from existing liquidity available to IPIC.

ENDS

The point is this: Apandi finds what he wants to find, sees what he wants to see. He won’t find evidences if he isn’t interested to look. Yet, if he did then recent developments made him looked like a fool, contradicting his exoneration of Najib and, paradoxically, showed that he lied in that judgment. The way out for Apandi, is simply to turn around and blame the MACC for failing to come up with those evidences. But this would be disingenuous.

Consider evidence from IPIC and from the PAC.

One, IPIC’s statements this April tell, in bottom line language: ‘we hold Najib ultimately responsible to give us back our money (US$1 billion) and we hold 1MDB complicit in lying to us, and in lying in their accounts about a payment that never arrived‘. After receiving the 1MDB money, Aabar BVI was wound up in June 2015. Yet this evidence means nothing to Apandi. You don’t think this strange, Lina?

Two, the US$1 bn owed to IPIC is just 14% of US$7.04 billion (MYR28 bn) the PAC has documented to be unaccounted for, a disappearance that started in Sept 2009 with US$1.03 billion and then continued until 2014. That is, for five years, evidences piled up to show not only a pattern in which money was siphoned out of 1MDB but they also pointed to fraud on an international scale. If a bunch of politicians closeted in a parliament room with little time, limited resources and limited access to documentary evidences can come close to such a conclusion how could the expert AG lawyers and Apandi himself see nothing?

Malaysians made Stupid by UMNO Lies

Today, even Arul concedes that some of the monies have disappeared, adding that 1MDB might have been scammed. This is a startling admission which contradicts numerous, earlier statements of his own. In particular, are his repeated assertions (a) that everything in 1MDB have been accounted for, (b) that assets exceed liabilities, and (c) rationalization, meaning the sale of nearly everything 1MDB once owned, will put a clean slate to 1MDB. Now, it looks like 1MDB will never, never, never come out clean.

So Lina, tell us, who has been lying?

For Apandi to say there are no evidence that traced 1MDB’s money back to Najib is not the same as saying the money never went to him. This raises a question: If the money is not with Najib, where the fuck is it? How about the like of Jho Low, with a turkey for a prince, and the Emirates men? How about those dodgy companies created to look like the real. How about Blackstone BVI, mentioned in the letter by the Saudi ‘prince’?

*

Click on image to read.

Click on image to read.

For you to appreciate the depth and the severity of the 1MDB scam, begin with names: Blackstone, Merryl Capital, Bridge. These aren’t just ordinary names, chosen for no good reason, then registered in some far-flung Caribbean islands. But, in taking on those names, Jho Low, Tarek Obaid, et al, gained overnight reputation and credibility they hadn’t earned.

The original companies — the Blackstone Group LP, Merrill Lynch (since 2009 renamed as Ridgemont Equity Partners) and Bridge Equity Partners — are US-registered private equity (PE) and venture capital (VC) firms. They act like banks without being subjected to banking laws because, instead of funding a corporate or an individual person they lend directly to projects with money they themselves had raised from banks, insurers and pension funds. Last year, Blackstone was managing assets worth US$311 billion, making it one of the world’s top three largest PE firms, and drawing 2014 revenues of US$7.5 billion. This makes it wealthier than Petronas.

It was, therefore, not without reason that Jho Low and the ex-Aabar and PetroSaudi officials, Badawy al Husseiny, Khadem al Qubassi, Tarek Obaid should pick those names for their island companies. It is called, fraudulent misrepresentation; more commonly known as lying. Aabar BVI wasn’t the only, nor their first, dummy company. There were: Blackstone BVI (as opposed to Blackstone Group), Merryl Capital (v. Merrill Lynch), Bridge Partners International Investment (v. Bridge Equity).

Riza Aziz–Rosmah’s Son

Yet, Apandi sees nothing wrong in all that: a string of dummy companies, all set up at short notice by the same clique, all short-lived, all resident in some Caribbean island, all shell companies.

Take Blackstone Real Estate that’s mentioned in the letter from the ‘prince’. It was registered in the British Virgin Island (BVI) on Nov 2010, stating at the time that foreign exchange was its business. Seven months later, it changed its name to Blackstone Asia Real Estate and in 2013 wound up barely 2 years and a half into its existence — and note, the year after money was remitted to Najib. In short, a bogus company set up for laundering money.

You see, Lina, Apandi didn’t want to know all that. Not wanting to know, not wanting to find evidences, Apandi would deny all MACC request for foreign assistance to inquire into those companies as well as the people behind them and the money deposited in them. The creation of these dummy companies, made to look identical to reputable ones, are the clear, irrefutable evidences of fraud.

But why did Apandi, and others like you, deny their existence? Or, deny that something seriously is amiss, lying instead? This is not some boys peddling cigarettes behind a schoolyard. Bogus princes, bogus companies, bogus ventures, bogus assets, bogus oil fields, bogus accounts, and bogus lovers are a dime a dozen in the World of Fraud. Even money may not be real, Lina. Ask Arul or Jho Low.

Inside secret desert and island places, the like of Arul mirror the sweet, Wharton business school talks of Jho Low, so hiding their fraudulent conduct. Fact is, US$7 billion is now formally acknowledged to have disappeared.

But Arul lied about that from the beginning, producing fancy charts and hiding their disappearance in financial jargon. (Bet you this, Lina: you had never heard of ‘Level 3 assets’ or financial ‘units’ before 1MDB.) Arul also says his work at 1MDB is done. What ‘work’ would that be? Cover up? In offering to resign over money vanished, he lies farther, suggesting that 1MDB is the victim when all the evidences point to it being the conduit and the vehicle in an international scam.

Arul’s statements, and those by the Saudi Minister, by your statement and your peers, as well as by Apandi himself have collectively become the evidences that demonstrated a concerted, deliberate attempt calculated to hide a scam, and the money and its trail leading — irrefutably — to Najib Razak. In repeatedly lying, Lina, you become complicit to the crime even though you might have no part of it.

You see, when you enter a profession such as the government Cabinet there is in it the means to do good to society. But even a greater temptation to do harm. You may encourage genius, you may chastise the incompetent, expose falsehood, correct error, and guide the lives of this age in no small degree by the speeches you make and the actions you recommend. Yet you commit to everything the precise opposite….

What are you, Lina? Why do you make a big deal out of the tongue of a towel head? Because, you know, no one believes Apandi? That being so, why should the few words of an Arab, minister or no minister, make a difference?

The problems surrounding Najib don’t rest in matters of beliefs. It is in a simple fact: the reality of a theft, billions. That has been Najib’s secret for a long time, which a thousand more Arab tongues can’t change nor erase. Is far too many secrets also weighing you down, Lina? You have a secret life you live? A secret nest somewhere, like Najib’s secret Mongolian women and secret deals?

Scaffolds don’t support buildings. It only looks like that; in truth it’s the other way around. Therefore, understand this, Lina: you are but a piece of scaffold around an edifice called 1MDB after — and this part is critical — it had been wrecked and laid to waste. You stand holding on to nothing.

1MDB is today way past been a legal and a political issue that you, Najib, et al have been flogging to no end. It is an ethical issue, which explains why all the Apandis and all the towel heads in the world, won’t make go away. As an ethical problem — that is, a question of being right or wrong, being true or false — it must have an ethical resolution. Guess what’s that?

Yours truly,

rihaku

rihaku

Above, is the sort of language of Seet Li Lin and the kind of Wharton business talk, the Wolf of Wall Street culture, you’d hear from Najib (recall him saying: ‘you help me, I help you’; ‘this is the deal…’) and Arul and Jho Low and Tim Leissner — all those financial scammers, gaming the system: “big on fluff, light on content, says a lot yet very little“.

You see, Lina, duplicity is characteristic hallmark of a scam. And guess who uses, who deploys, such language with so much frequency and regularity? Arul Kanda top the list. Next, Najib Razak. Recall him telling The Star: “Yes, the bank account is in my name. But, understand, although the account is my name, it is not personal.”

This sort of gobbledegook is the language of snake oil salesmen — and financial salesmen as well, people like Jho Low, and Tim Leissner, and Seet, and Goldman Sachs, and Tarek Obaid and their band of Arabian camel traders masquerading as sheikhs and princes.

Then there are ministers, people like you and that Saudi bloke. Who’s been lying, Lina? You. You have been scammed, deceived, lied to, after which you repeat their lies. Can you feel your own lies moving the earth… (see Seet’s email below)?

The earth began moving on September 30 2009. But why? That was the opening bid in the Great Malaysia Scam — starting with US$700 million, now way past US$4 billion, all gone, and still rising. Two years later, Seet would be gloating: ‘he and others had gamed the system’.

This ‘gaming the system’ went on for five straight fucking years, billions upon billions, all right under Najib’s nose while you, Lina, holds up his flag with the gall to say he told the truth. But the truth is you, Lina, don’t want to know — to know that Najib Razak, human as he is, is capable of thievery on an unprecedented global scale in such a short time, unmatched by any head of government, democrat or dictator, dead or alive.

*

It began with MYR 2.6 bn; now it’s going through the roof. Why, Zaid, is that so hard to understand, even by the kampung?

*Altantuya All Over Again & the 1MDB Calculus

*

Variants of the above calculus, the Black-Scholes financial equation, are circulated in stock and financial trading halls. This is done by constructing ready-to-use formulae then bundling them into the hand-held calculators for Wall Street bankers and derivatives, options and bond traders like Nick Leeson.

Those equations are rarely in use today, victim of Black-Scholes fallibility and incipiency. Here is a list of its victims: Metallgesellschaft, Orange County, Sears Roebuck, Proctor & Gamble, all came to near collapse from heavy derivatives trading losses before and during 1994.

A year later there were Daiwa and Barings Bank and the latter’s employee Nick Leeson, the Briton in Singapore who relied on those equations to buy and sell bonds and Japanese index options, that is, ‘I-owe-you’ debt papers based on the high and lows (volatility is another word) of the country’s stock exchanges. Bank Negara’s losses in the 1990s’ sterling-USD-ringgit trades follows a similar pattern.

Barings was a century-old when it collapsed, done in single handedly by Leeson, whose losses wiped out the bank’s entire 1 billion Pound capital base. But this was not because Leeson, a high school dropout (like Petra Kamarudin), couldn’t fathom Black-Scholes. What is there to understand anyway? It was because high finance, like Las Vegas, has no morality, no God.

That amorality — no, immorality — underlies the same Wall Street culture taught in Wharton business school, driving the energies in the like of Tim Leissner and Low Taek Jho and Arul Kanda and their schoolmate hangers-on and underlings like Sharol and Tiffany, and like Casey Tang and Seet Li Lin.

Zaid Ibrahim made the observation that Malays, unable to understand the workings of Wall Street and high finance, turns readily to God, Zakir Nair being their conduit to Heaven. If only that is true: we, too, would queue up to get some of the Zakir holy sprinkles.

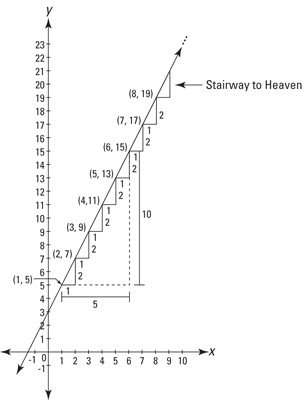

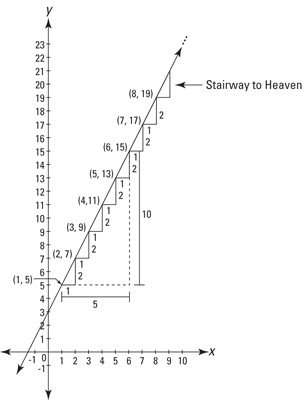

But Zaid was wrong on two counts. High finance being impenetrable to common people is a myth: just ask Leeson. And that, in its turn, leads to Zaid’s second error, which is that God is far more readily accessible than Black-Scholes, which for those still puzzled by it is actually a third-level differentiation of this; just two steps up:

A derivative (from the root word, differ) is simply the measure of a slope or its steepness:

Give the above equation a formula, the result is this:

Add many more variables other than x and y, insert a time-line into the chart, you will get the Black-Scholes’ formula. At its root it is algebraic, a third-level differential calculus. That is, it being derived from the difference in the steepness of slope and, of that, one more difference. In sum, a differential three times over. Another way of saying the same thing: the change over a change over a change. There is nothing incomprehensible about that.

If Zaid is indeed wrong, then his task, in speaking to the kampung, isn’t to teach Malays how Goldman Sachs created, then bought and sold bonds through a Black-Scholes formula. That would be completely unnecessary, and it would be fallacious as well.

Rather, it is to speak simply of the immorality in 1MDB and SRC, the godlessness of its people, Najib and Arul in particular. Worse than the godlessness, is today the trade of lives — Najib himself breaking even his own ‘you-help-me, I-help-you‘ credo. And this godlessness is in spite of his frequent Saudi visits, there trading the souls of Malay soldier-boys for princely Arab favors.

Now, with formal admission that up to US$7 billion might have been embezzled (vanished is the polite word), Najib’s sycophants, beginning with Azalina, are clearly attempting to completely severe the man from any association with 1MDB. After which — and you can see it coming — they will help Najib wash his hands clean of the affair by throwing out the rest of 1MDB people under the bus, beginning with Sharol Halmi.

Such a thing is the trade of lives; buying and selling people, first with cash and now it is with god and piety, or the pretense of it.

All this charade follows the same pattern in the Altantuya Shaariibuu’s murder. It is Mongolia all over again. Recall Najib texting Razak Baginda: ‘be cool’, things are being sorted out. And, lo and behold, Razak, after some minor inconveniences, gets to live out the rest of his life in the UK; Sirul Azhar Umar gets to slip out to Australia from under his jailers’ noses, plus that of an entire police force and all Immigration. Nobody gets hanged.

In Malaysian morality, if you can get away with murder you can get away with US$7 billion — and still counting. That’s the godless morality message for the kampung, Zaid, not Black-Scholes, and not how bonds are created and traded. Those are just money in the form of an A4 letterhead. In a word, a derivative.

Now, Zaid, is all that so hard to understand? As humans we can only take in so much. Malays in the kampung are so filled with gods there is really little room left in them for this world. Take out the god then you, Zaid, might just make some room for them to know Black-Scholes and its worldliness, both ugly and beautiful. This eagerness to tackle the world, if you hadn’t been told, occupies much of Chinese philosophical thinking…

To put the politics technically: We’ll have to get rid of God, then to take back our morality and return it to politics with the primacy it deserves over other basic forces, including Law, Money and King. Cash must be defeated as the King of Politics. Long live the Revolution!